search results

.svg)

We couldn’t find any results for “perational”. Try a different search term or search on Ask Richard.

Go all reports

Accounts Receivable

sku:

REPORT-00031

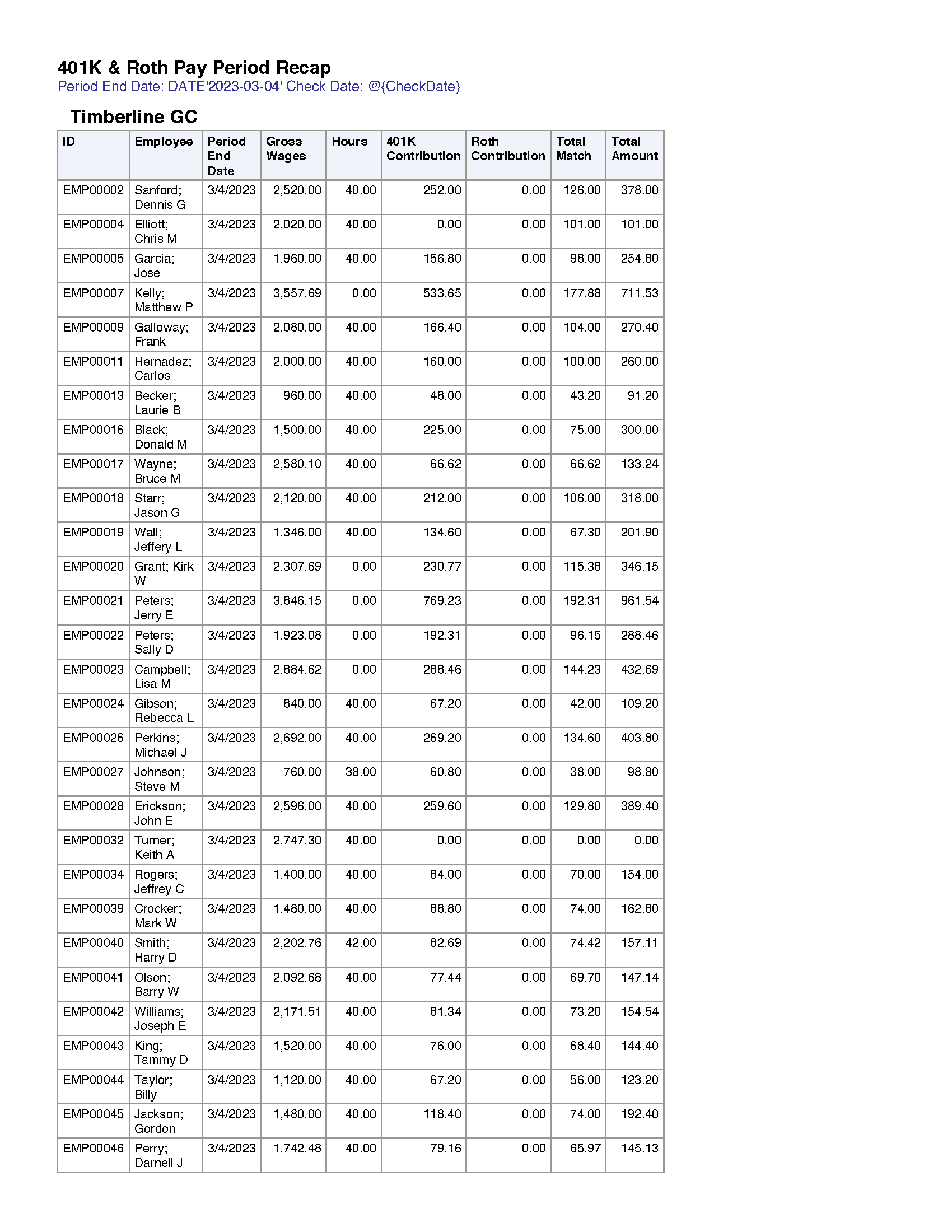

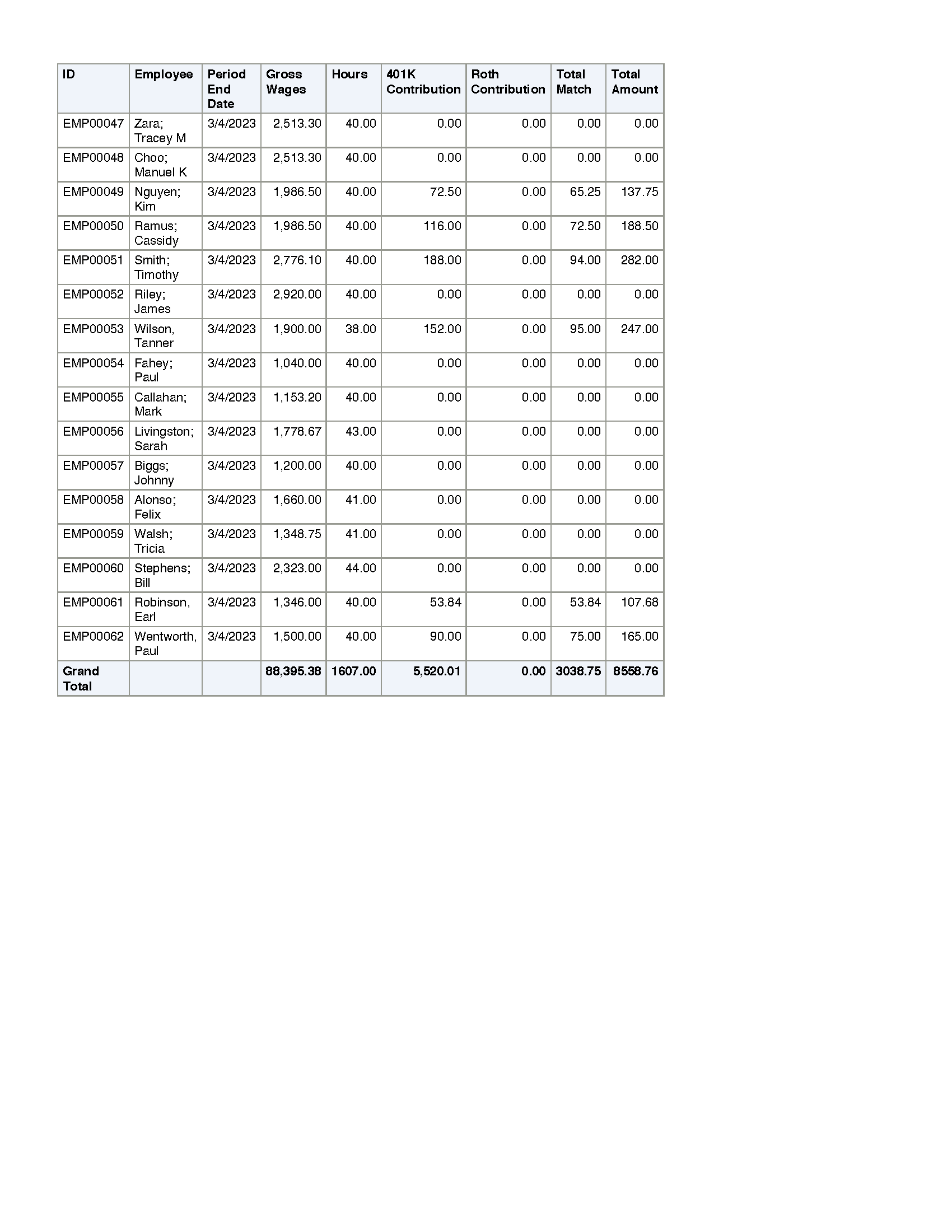

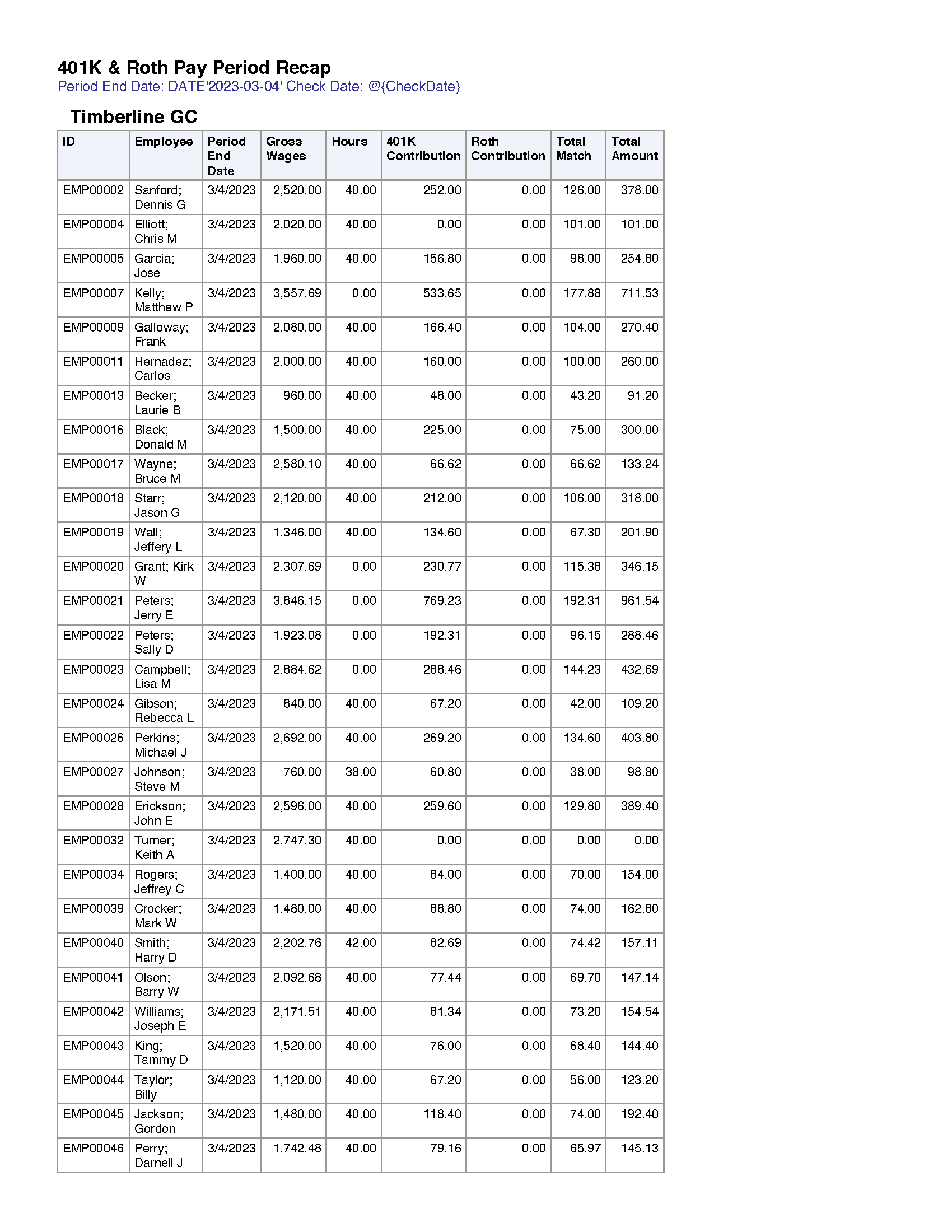

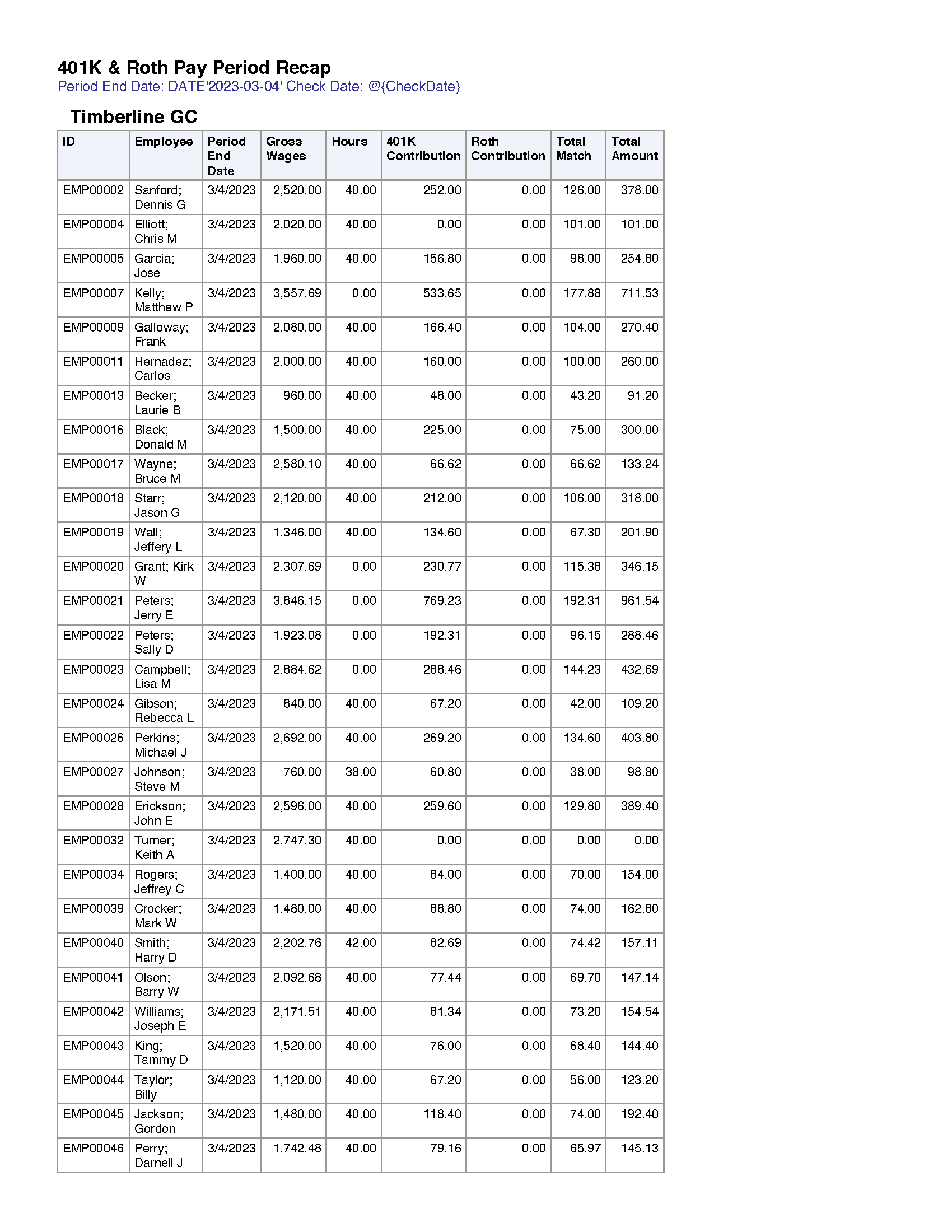

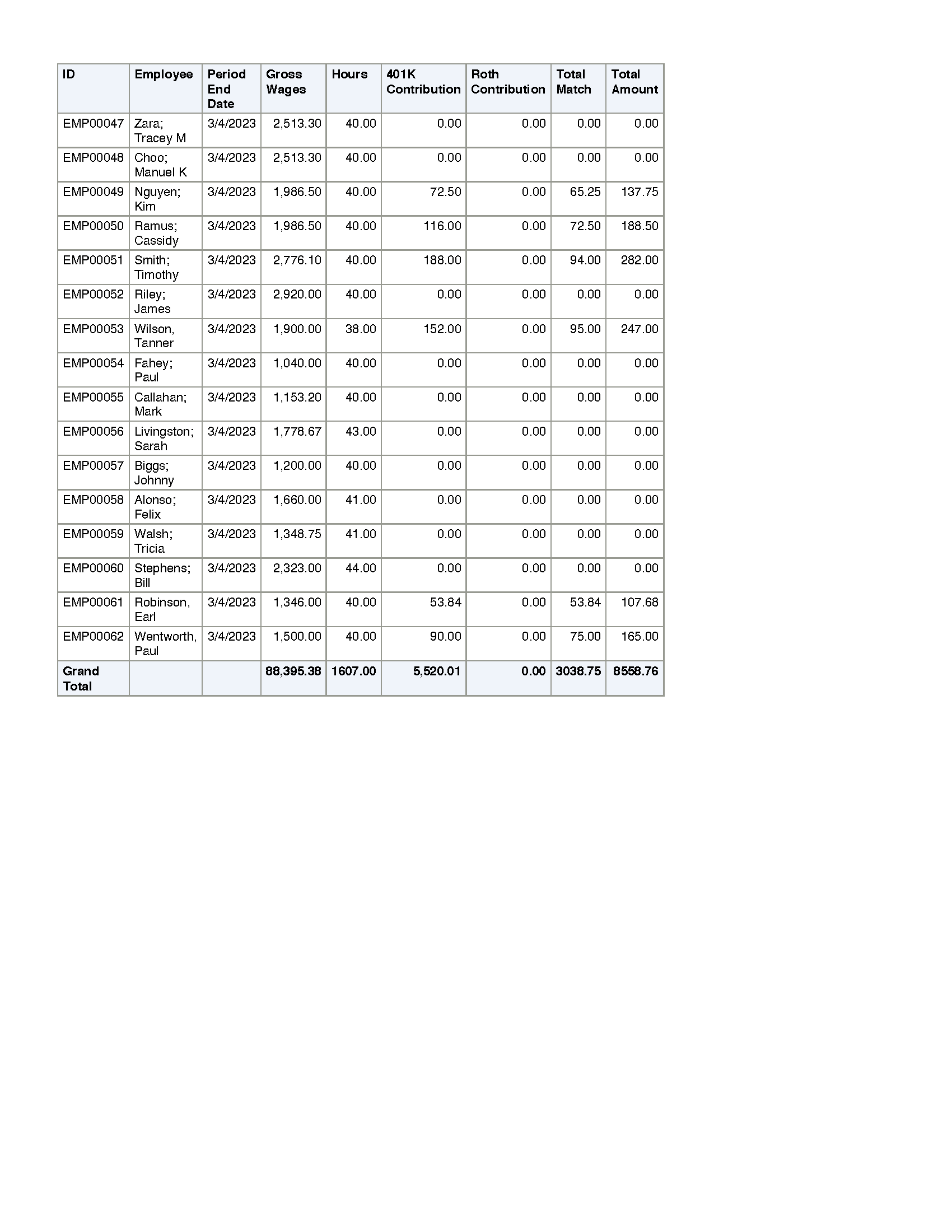

Sage Intacct 401K and Roth Pay Period Recap

$

Included in Premium

Summarizes 401(k) and Roth contributions, employer matches, and gross wages by employee for a given pay period, supporting payroll processing and compliance.

ICRW (Interactive Custom Report Writer) is required to access and run this report.

You'll need to purchase the Velixo module to access this report.

No items found.

No items found.

Description

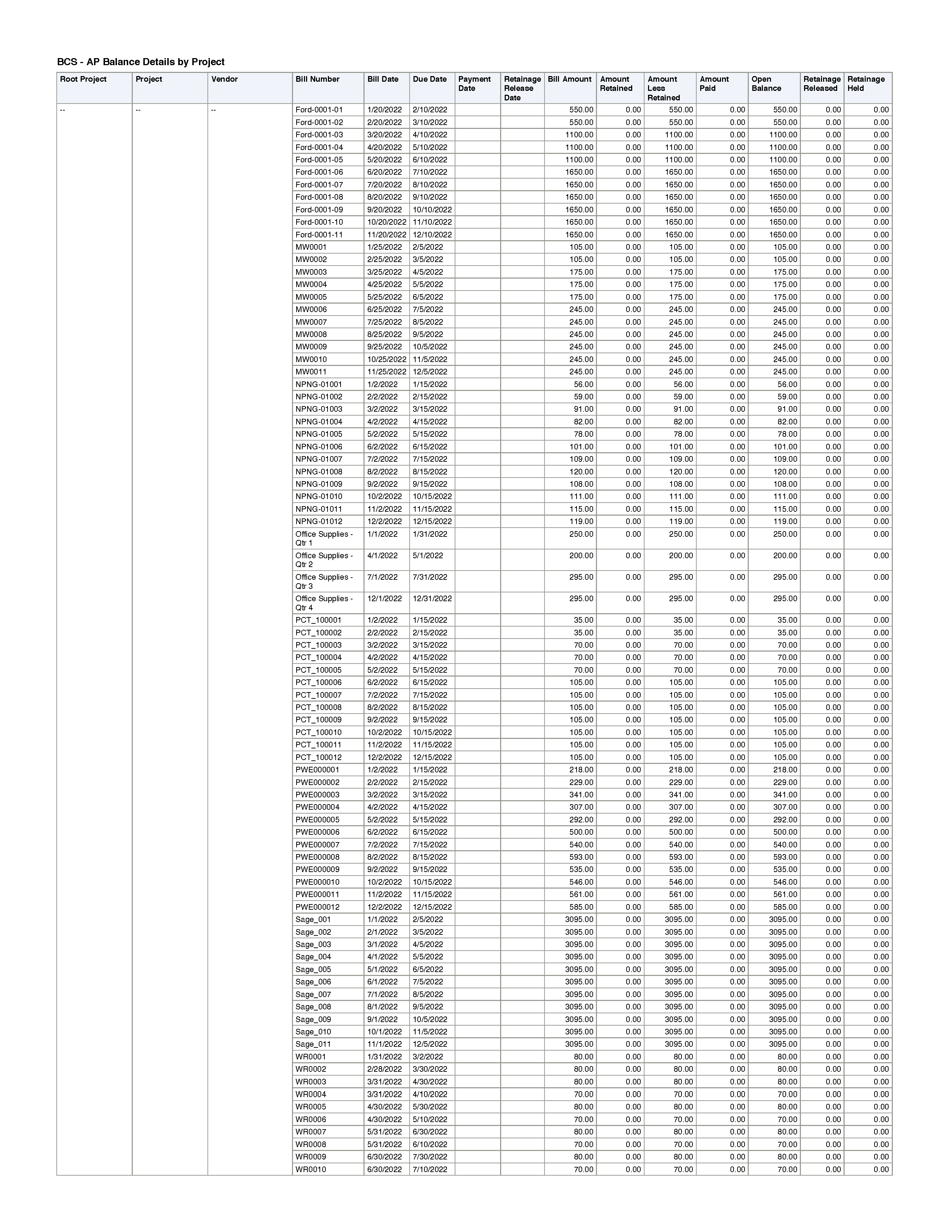

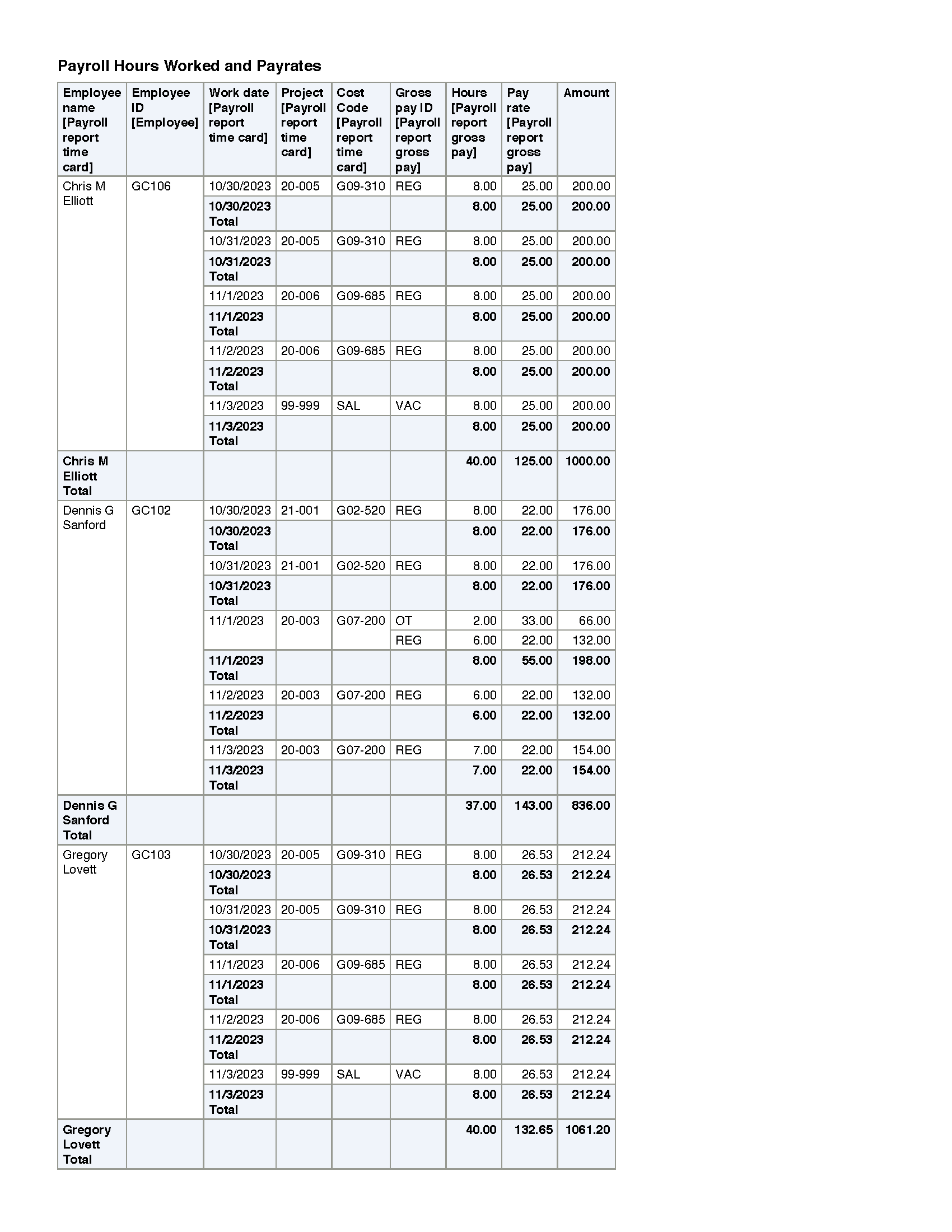

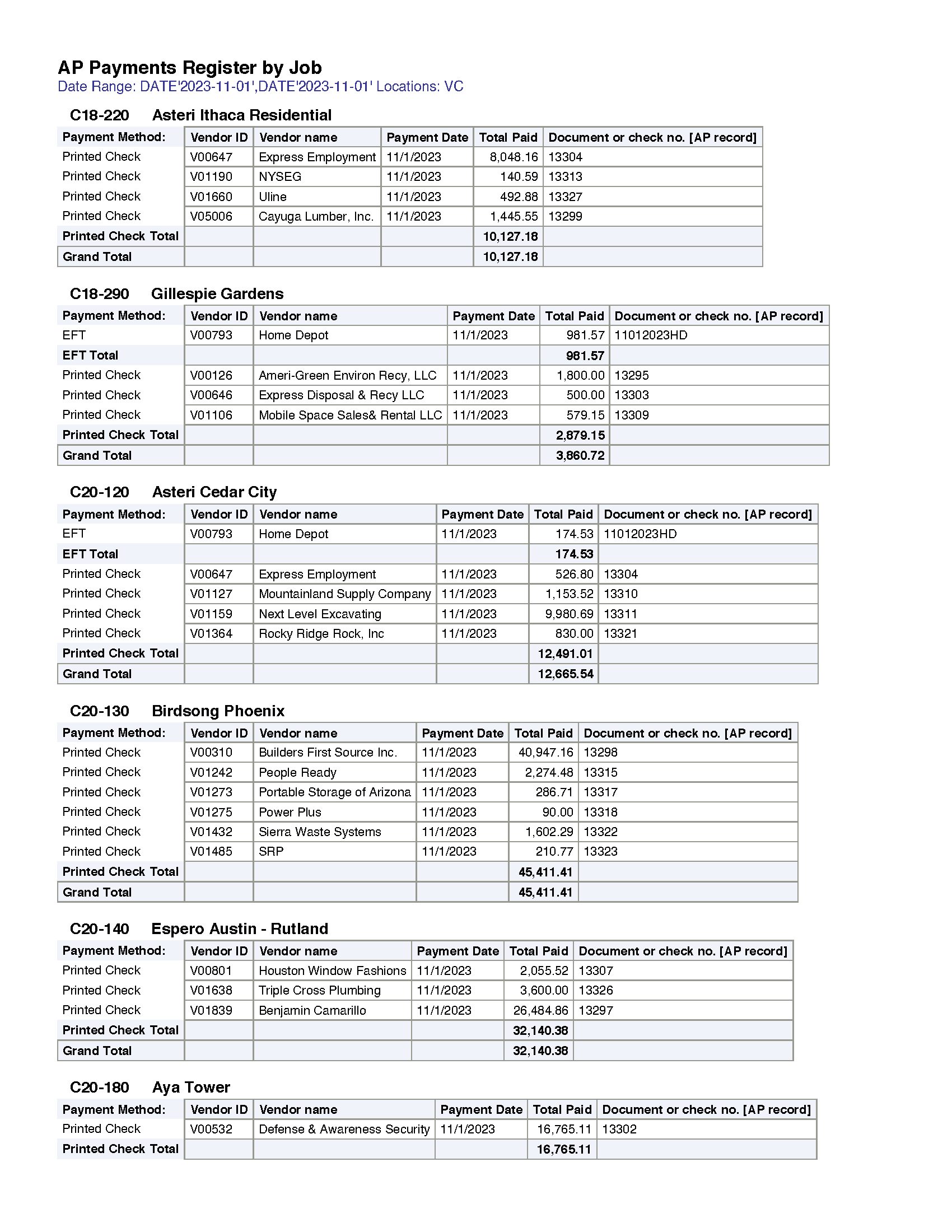

This report provides a detailed breakdown of 401(k) and Roth retirement contributions, including employee contributions, employer match amounts, and total payroll amounts for each employee within a specific pay period. It is an essential tool for payroll administrators and finance teams managing retirement plan deductions and ensuring compliance with company and regulatory requirements.

Key Features:

- Employee-Level Breakdown: Displays gross wages, hours worked, 401(k) contributions, Roth contributions, and employer match amounts by employee.

- Pay Period Recap: Summarizes total contributions and employer matches for accurate reporting and reconciliation.

- Retirement Plan Compliance: Helps track 401(k) and Roth contribution limits and ensure deductions are properly applied.

- Payroll & Benefits Auditing: Supports audits and reporting requirements for payroll and benefits administration.

- Total Pay Period Summary: Includes grand totals for wages, contributions, and employer matches across all employees.

This report enhances payroll accuracy, benefits tracking, and compliance monitoring within Sage Intacct.

Related reports